© 2020 All rights reserved to Maaal Newspaper

Publisher: Maaal International Media Company

License: 465734

Saudi banking assets crossed US$1 trillion landmark as double-digit growth continues

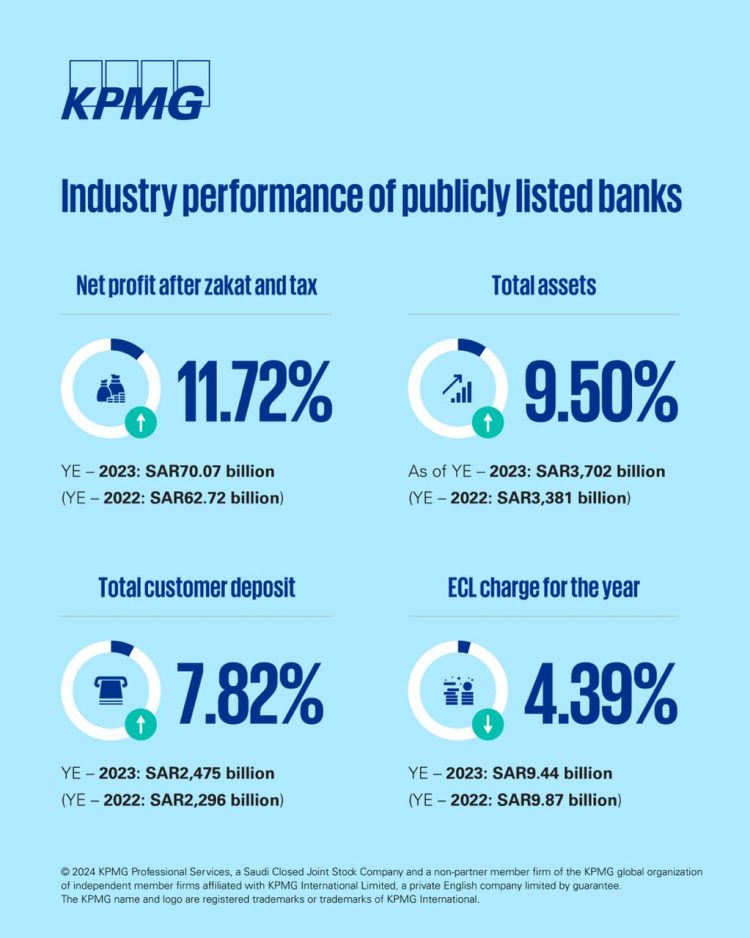

The financial results of the 10 banks listed on the Saudi Stock Exchange (Tadawul) demonstrated a robust industry performance in 2023, reflecting an increase in net profit by 11.72 percent year-on-year (YoY) and total assets growing by 9.5 percent to reach close to the US$1 trillion landmark at the year end.

The net profit after zakat and tax reached SAR 70.07 billion last year, compared to SAR 62.72 billion in 2022. Total assets rose to SAR 3,702 billion in 2023 from SAR 3,381 billion in 2022 and momentum continues in 2024, according to a banking performance report by KPMG, a leading provider of audit, tax and advisory services in Saudi Arabia.

The banking industry has leveraged the benefits of economic expansion and a higher interest rate environment. As a result, loan books increased by 10.63 percent, while deposits rose by 7.82 percent. A proactive and long-term approach was adopted to bridge the liquidity requirements by capitalizing retained earnings and issuing long-term sukuk.

The increase in net profit was underpinned by an increase in net special commission income by 10.89 percent and a decline in expected credit loss (ECL) charge by 4.39 percent YoY.

“ECL allowances dropped due to better portfolio performance across wholesale and retail segments and no systematic default incidence this year. The economic expansion has rather supported distressed borrowers to settle and favourable renegotiate their debts,” noted Ovais Shahab, Head of Financial Services at KPMG in Saudi Arabia. “Timely repricing of assets and liabilities has also resulted in increase in net margin, while the industry’s fee income also grew by 2.43 percent.”

The industry’s loan-to-deposit ratio stands at 99.2 percent which is on the higher side, especially in view of promising economic outlook and healthy asset growth prospects. Multiple measures were introduced to maintain sufficient liquidity in the banking system that could foster growth and fulfil domestic requirements. Accordingly, banks have continued to pursue strategies of recapitalization of retained earnings and issuance of sukuks in domestic and international markets for stronger financial position.

KPMG has further commented in the report that going forward risks seem more interconnected and emergent in the global banking industry and that is partially relevant for the wider region as well. Geopolitics uncertainty has emerged as the top risks that could hamper growth momentum in multiple countries, while disruptive technologies and operational issues remain equally relevant for all economies. In parallel, generative AI is taking hold with seemingly limitless potential, requiring the industry to keep its foot on the gas in terms of investment and exploration of the technology.

“The Saudi Central Bank (SAMA) continues to be active in dialogue with the market participants, playing a pivotal role in managing risks and supporting the ambitious economic expansion agenda of the Kingdom,” Shahab concluded.

Related