© 2020 All rights reserved to Maaal Newspaper

Publisher: Maaal International Media Company

License: 465734

Reiterating urging taxpayers concerned to hastily meet mandatory requirements

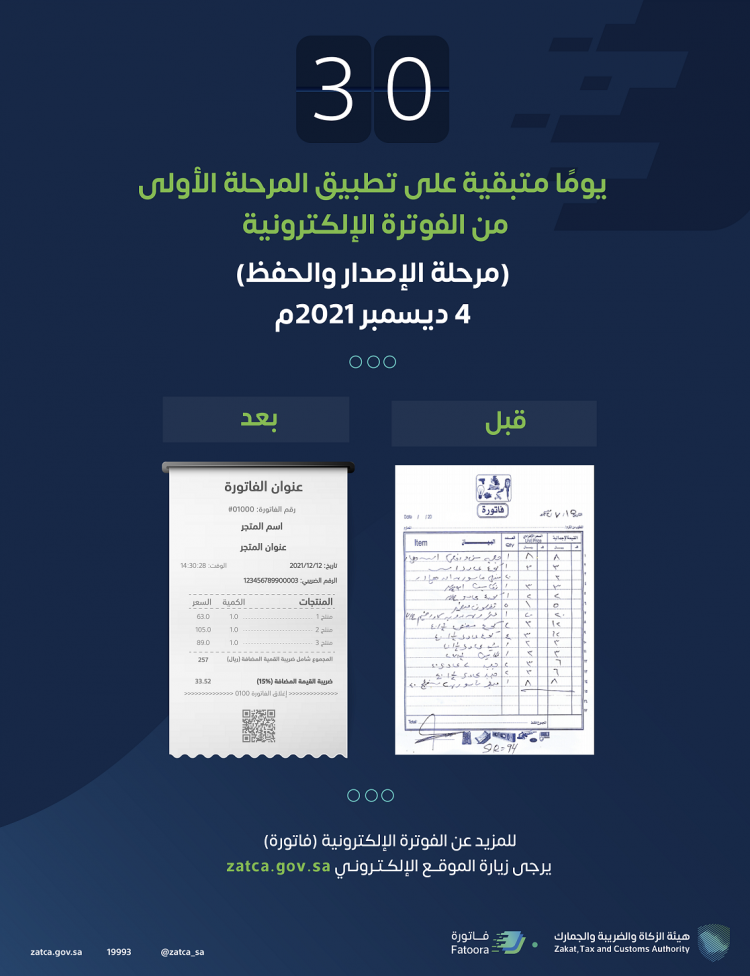

Only 30-day to go for Effecting E-billing -Zakat Authority Says

The Zakat, Tax and Customs Authority called on taxpayers subject to the electronic billing regulation, to expedite meeting the requirements of its first phase, with only 30 days remaining, as it shall enter into force on December 4, 2021.

The authority clarified that the requirements for compliance with the first phase of electronic billing are to completely stop using handwritten invoices or invoices written on computers, through text editors or a number analysis programs, as well as making sure that there is a technical solution for electronic billing, compatible with its requirements.

The requirements also include ensuring the issuance and preservation of electronic invoices with all elements, including the QR code for simplified tax invoices, and the tax number of the buyer registered in the value-added tax for tax invoices, in addition to making sure to include the invoice address, according to the issued type.

“Zakat, Tax and Customs” stressed that taxpayers subject to electronic billing can view the non-binding indicative list for providers of technical solutions for electronic billing, which was previously published on the authority’s website and are available, by accessing the link, in order to choose the appropriate technical solution for the size of the facility and the type of sector, stressing that it is not understood from the list that the provision of electronic billing solutions, is limited to them.

Taxpayer shall be considered legally compliant, on meeting the requirements for electronic billing, using any technical solution.

The Zakat, Tax and Customs Authority called on taxpayers subject to electronic billing, providers of electronic billing systems, and those interested, to communicate with it for any inquiries related to electronic billing (invoice), through the unified call center number (19993), operating 24 hours a day, 7-day a week, or the account “Ask Zakat, Tax and Customs” on Twitter (@zatca_Care) or through e-mail ([email protected]), or via instant chats on the website (zatca.gov.sa).

Related