© 2020 All rights reserved to Maaal Newspaper

Publisher: Maaal International Media Company

License: 465734

PIF/STC telecom tower deal brings number of towers transferred to third-party ownership to approaching 100,000 in the MEA in the last five years

United Arab Emirates-based premier telecom, media, and technology (TMT) strategic information consultancy, Pursuit Mode Initiatives, publisher of the Comm. Decisive Dozen list of top performing telecom leaders in the Middle East and Africa (MEA), suggests that today’s confirmation of the Public Investment Fund (PIF) of Saudi Arabia’s plans to acquire a controlling 51% stake in Telecommunication Towers Company Limited (TAWAL) from STC Group is yet another example of the vibrant state of the managed telecom tower sector in the MEA and other emerging geographies.

The consolidated new entity in Saudi will be owned 54% by PIF and 43.1% by STC, with the remaining minority shareholding held by Golden Lattice Investment Company (GLIC). Last August, TAWAL acquired the telecom infrastructure assets of Netherlands-headquartered United Group in Bulgaria, Croatia and Slovenia following the acquisition of AWAL Telecom, an independent passive tower infrastructure provider in Pakistan, in 2022. TAWAL’s expanding portfolio of towers sets the company to form the Middle East’s largest independent tower company in the process, owning approximately 30,000 mobile tower sites across markets, with annual revenues forecast to top US$ 1.3 billion.

30,000 towers under management appears a market leading position for the region, given the December 2023 announcement by Zain and Ooredoo Groups of plans to combine their passive tower assets across Qatar, Kuwait, Jordan, lraq, Algeria, and Tunisia under a newco that includes Zain-owned TASC Tower Holdings. The telcos forecast the new entity will similarly boast approximately 30,000 towers under management upon commencement of operations, with a projected run-rate revenue close to US$ 500 million annually.

While smaller numbers are involved, the independent passive infrastructure management scene in Africa is also operating on a high ebb, as last month South Africa’s Telkom SA announced plans to sell its Swiftnet mast and tower business constituting 4,000 towers to a consortium of equity investors, valuing the entity at US$ 356 million. Meanwhile, in a move said to currently be under contemplation, Telecom Egypt is reported to be in talks with three companies for the potential sale and leaseback of a portion of its tower portfolio in the country. Bids are said to range between US$ 150-250 million for approximately 2,500 of the telco’s 2,800 towers, which would add to a growing list of tower transactions across the continent.

Tawanda Chihota, Principal and Executive Director of Pursuit Mode Initiatives FZE said, “Today’s announcement out of Saudi Arabia reinforces the perceived value telcos across the MEA are assigning to the outsourcing of passive elements of their networks, which then allows them to concentrate more earnestly on customer experience and innovation.”

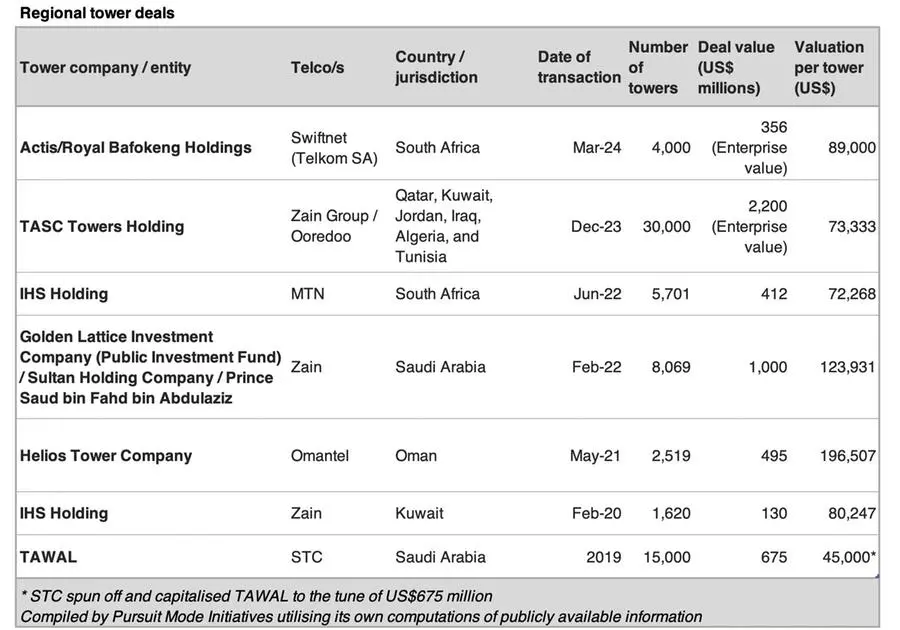

Chihota continued, “Managed and outsourced network services have been part of the industry for some time, but we have seen an uptick in tower sale and leaseback agreements in the MEA region in the last five years. Including the PIF/STC transaction, a non-exhaustive review of publicly announced agreements in the region over the last five years shows that approaching 100,000 towers have been or are being planned to be passed on to independent entities over this period.” (See Table 1 below)

“A combination of heightened competition in mature markets and higher operating costs with respect to fuelling, managing, and securing tower infrastructure has made the outsourcing of passive infrastructure an attractive option for telcos, with an upfront payment from a sale which improves cashflow, and can be utilised to pay down debt or fast-track customer-centric activities and support the introduction of new, revenue-generating income streams.”

Related