Publisher: Maaal International Media Company

License: 465734

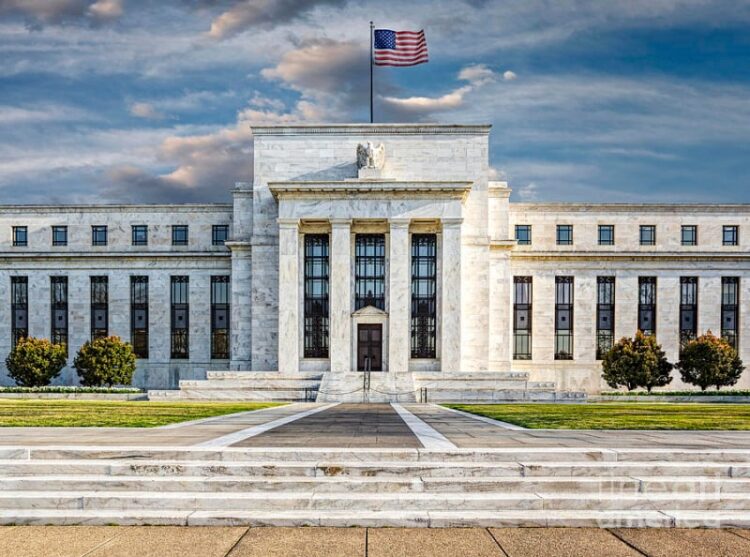

WSJ: US Fed Reassures Investors by Keeping Interest Rates Unchanged

اقرأ المزيد

Wall Street Journal reported that the Federal Reserve, the US central bank, did not hint at adopting more hawkish policies regarding the impact of tariffs on prices after its last monetary policy meeting. This reassured investors and had a positive impact on the US stock market, which closed higher after the bank left interest rates unchanged.

The Federal Reserve kept its benchmark interest rate unchanged in a range of 4.25-4.50 percent and indicated the possibility of a quarter-percentage-point cut later this year. Stocks continued their gains after Federal Reserve Chairman Jerome Powell’s press conference, in which he indicated that it was still too early to determine the impact of tariffs on inflation. At the close of trading, the Standard & Poor’s 500 index rose 60.62 points, or 1.08 percent, to close at 5,675.44. The Nasdaq Composite Index rose 247.57 points, or 1.41 percent, to 17,751.11. The Dow Jones Industrial Average advanced 386.61 points, or 0.93 percent, to 41,967.92.

The newspaper noted that Federal Reserve officials expect price growth to slow during 2026 and 2027, meaning they see no need to set interest rates differently than they were before the tariffs were imposed. In this regard, Powell stated that inflation can sometimes be transitory and therefore may not require immediate intervention from the central bank. Economists believe the market needed signals to reduce uncertainty, but Powell’s remarks failed to allay concerns about market volatility, especially after US stocks came under increasing selling pressure in recent weeks due to economic data indicating a potential slowdown in economic growth and declining consumer confidence amid growing concerns about new trade policies.

The Wall Street Journal reported that Federal Reserve officials have sought over the past year to strike a balance between combating inflation and maintaining stable economic activity. Inflation has made significant progress toward the bank’s target, reaching 2.5 percent in January, up from 5.5 percent two years ago.

In an effort to avoid the impact of the sharp interest rate hikes witnessed during 2022-2023, the bank cut interest rates by one percentage point between September and December of last year, but at the same time, it does not want to undo the gains achieved in combating inflation.

Powell emphasized during the press conference that “our monetary policy actions are guided by our dual mandate to promote maximum employment and achieve price stability for the American people.” The newspaper quoted Michael Reed, chief US economist at RBC Capital Markets, as saying that the Federal Reserve is facing an “increasingly difficult situation,” as signs of a slowing labor market emerge, although the full impact may not be evident in the current employment reports, while tariffs could push up inflation rates for the rest of the year.

It added that continued price increases coupled with slowing growth—known as “stagflation”—could make it difficult for the Federal Reserve to cut interest rates to prevent an economic slowdown.

It noted that the Fed’s response will depend largely on businesses’ and consumers’ expectations of inflation, as central bankers believe that these expectations can become reality if individuals and businesses adopt them in their financial decisions.

Some surveys that attempt to measure consumer expectations regarding inflation have recently shown increased or greater uncertainty about the inflation outlook. Meanwhile, the new economic forecasts revealed that 11 of the Fed’s 19 policymakers expect to cut interest rates at least twice this year, down from 15 officials who predicted the same thing last December.