Publisher: Maaal International Media Company

License: 465734

Perfect Presentation “2P” earnings release for the year ending 31 December 2023

اقرأ المزيد

Perfect Presentation for Commercial Services Co. (“2P” or the “Company”, 7204 on the Saudi Exchange), a leading ICT solutions provider in Saudi Arabia, has announced its financial results for the year ending on 31 December 2023 (“FY23”), recording a solid top line performance, which is mainly arising from Software Development, which increased significantly by 82% year-on-year (“YoY”) and contributed 37% to the total, and Operation and Maintenance, which grew 8% YoY and contributed 34% to the Company’s consolidated revenues. In line with the Company’s strategic focus on diversification, 2P launched two new lines of business, Cyber security and Infrastructure, which are expected to start contributing to the company financial statements from 1Q2024 onwards.

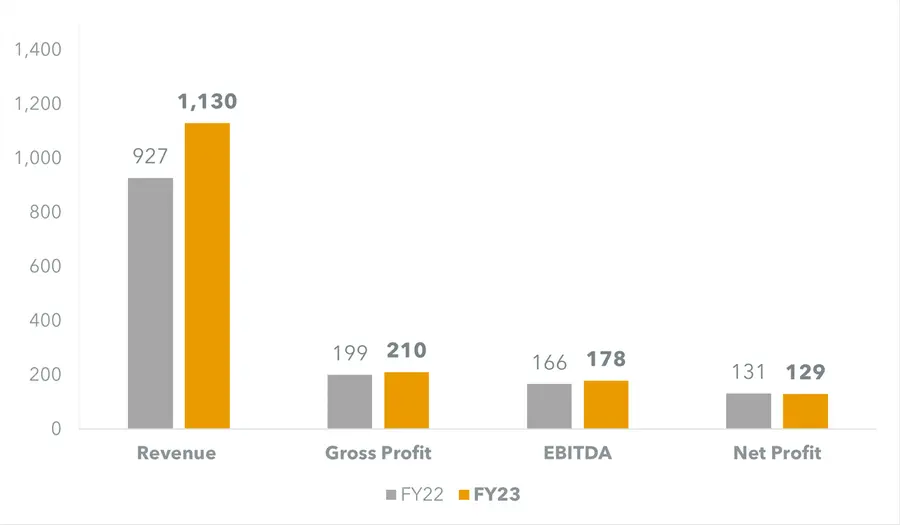

Financial overview

Revenues increased 22% YoY, from SAR 927 million, to SAR 1,130 million in FY23, essentially due to the continued growth in revenues for Software Development and Operation & Maintenance during the year.

EBITDA reached SAR 178 million in FY23, thus increasing 8% YoY, when compared to SAR 166 million in FY22, driven by the robust top line performance during the year. This translated to a decrease in EBITDA Margin from 17.9% in FY22 to 15.8% in FY23.

Net Profit marginally declined by 2% YoY from SAR 131 million to SAR 129 million, primarily due to a 53% rise in cost of financing, due to an increase in SAIBOR rates.

Backlog amounted to SAR 1.5 billion as of 31 December 2023, compared to SAR 1.7 billion at the end of 2022, and the company continued to strengthen its position in the market, through an increasing focus on diversification, with the launch of two new lines of business, Cyber security and Infrastructure.

Ehsan Doughman, CEO of 2P commented:

“We are delighted to be concluding yet another successful year for 2P, with a strong operational and financial performance in 2023. This is largely attributed to our unwavering focus on providing innovative, cutting-edge technologies and software solutions to our clients, both in the private and public sectors.

Reflecting on our journey so far, we take pride in continuously enhancing the diversity and integration of our comprehensive portfolio of products and services, with the launch of Cyber security and Infrastructure. These two new lines of business are expected to unlock further opportunities for us to expand our operations and reinforce our position in the rapidly growing domestic market.”

In SAR millions

Maher Bawadi, CFO of 2P said:

“2P has reported a solid set of financial results in 2023, with a sustained positive momentum for our top line performance, supported by the continued growth in our core business segments, particularly Software Development and Operation & Maintenance. Our commitment to operational excellence in everything we do, complemented with a favorable operating environment in the Kingdom, is enabling us to expand the range of services that we offer to our growing customer base.

Supported by a robust financial and market positioning, we are proud to be at the forefront of innovation and growth in our sector and will continue to cater to the evolving demands of our customers with the same level of dedication.”

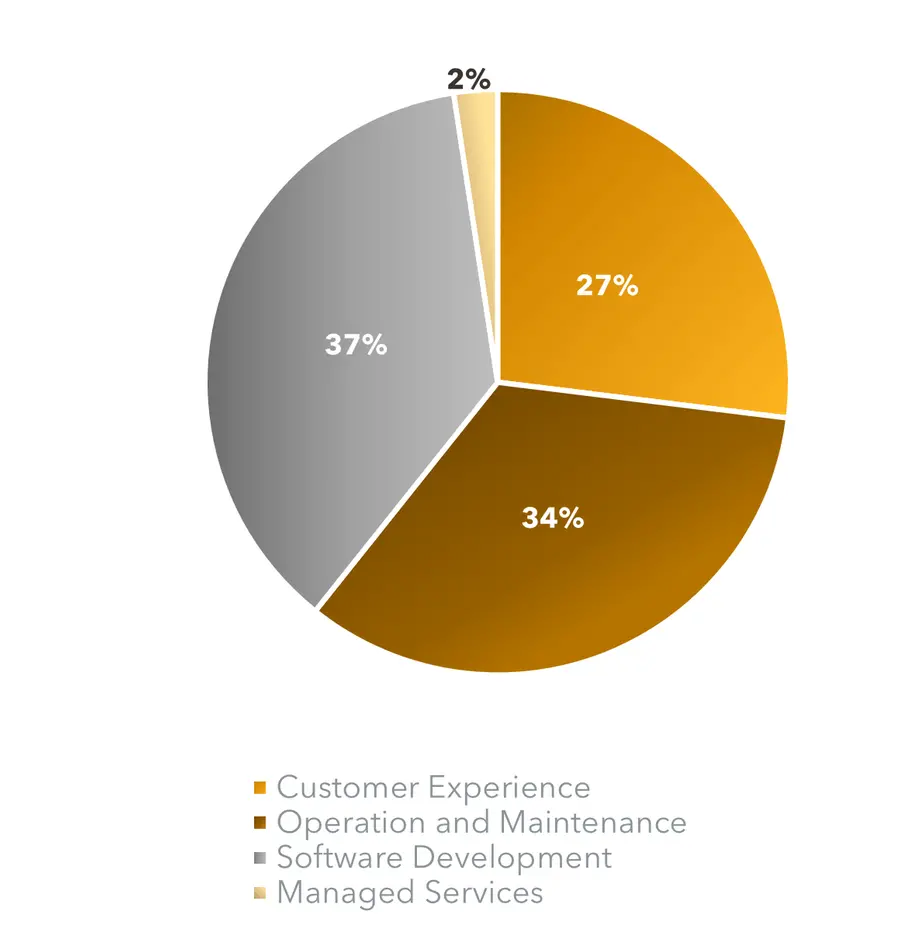

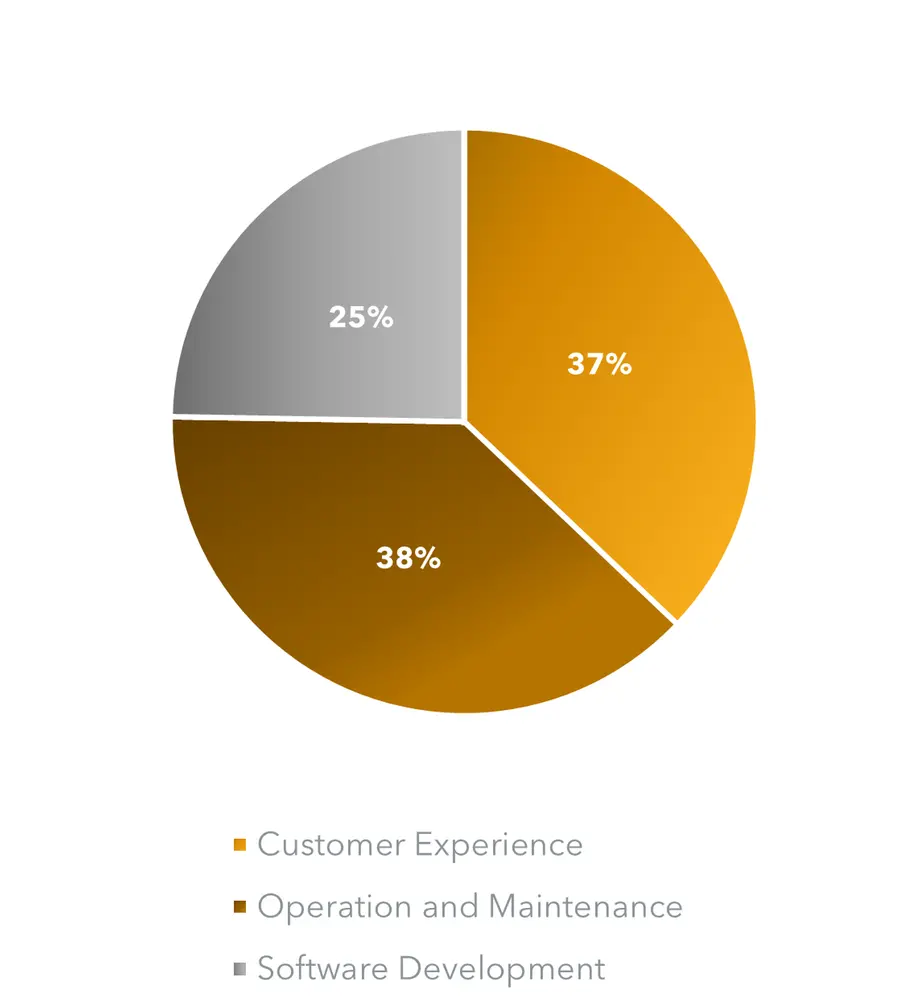

Segmental Analysis

Customer Experience revenues declined 11% YoY to SAR 304 million in FY23 and accounted for 27% of the total revenues. This was mainly due to the successful completion of key projects during the last few quarters. 2P continues to focus on exploring new avenues for the growth of its portfolio and is aiming to capitalize on the promising prospects of the business process outsourcing (BPO) market in the Kingdom.

Operation and Maintenance exhibited growth in revenues of 8% YoY to SAR 381 million in FY23 and comprised 34% of the total. This is essentially the result of a robust pipeline of key project awards in addition to the completion of a strategic shift towards managed services for information technology, supported by the use of advanced AI-enabled tools to achieve customers’ desired objectives.

Software Development revenues significantly improved by 82% in FY23 to SAR 417 million, contributing 37% to the company’s consolidated revenues, which was primarily driven by the well-established and strategic partnerships with world-renowned organizations, and is aligned to 2P’s focus on enhancing innovation, particularly in sectors such as blockchain, fintech solutions, and collaboration platforms.

Managed Services was launched during the 2nd quarter of 2023 and has been demonstrating robust growth, with revenues increasing from just SAR 3 million to SAR 27 million for FY23, and accounting for 2% of the total. 2P remains focused on diversifying its revenue streams and evolving its portfolio to address the rapidly changing needs of its clients.

Revenues by Line of Business

| FY23 |

| FY22 |

Key highlights during 4Q23

- The company was awarded an open-ended framework agreement to provide administrative, strategic, technical, and legal consulting services to the Ministry of Investment for the Information Technology Consulting track. The agreement will run for four years, with an annual limit of SAR 500 million. The project aims to provide the necessary advisory support for strategic requirements and business development, in order to ensure the achievement of the Ministry’s targets in line with this track.

-

2P was awarded the managed services project for health information systems for the University Medical City at King Saud University for SAR 59 million. The project aims to provide managed services for the health information systems of the University Medical City and includes the following services:

- Software and application services

- Database services

- Business intelligence services

- Information, systems and operation center services

- Network services, digital communications and information security

- Technical support services for users

- Educational media services

- Technical and quality project office services

- Knowledge transfer services

-

The Company announced a contract sign off in an amount of SAR 47 million for the process of operating information technology services at the Ministry of Hajj and Umrah. The project aims to provide information technology services, including:

- IT-PMO project management

- Operation and management of the Ministry’s databases

- Operation and management of servers and operating systems of all types

- Operation and management of VMware virtual machines

- Operation and management of information security

- Operation and management of the Ministry’s internal and external networks and connection circuits of all types

- Operation and management of the unified communications system, electronic fax, and low-current systems

- Operation, support, and development of systems and applications

- Analysis of business requirements, design, and development of new systems and applications

- Operation and management of the external and internal portal and its subsidiaries

- Analytical reports for performance monitoring and decision-making

- Operation and management of Microsoft applications, email, and smart devices

- Operation and management of the desktop infrastructure system (VDI)

- Technical support for all beneficiaries of the Ministry’s technical services

- Implementation of quality policies and performance monitoring

- Operation and management of the digital transformation process

-

2P was awarded the project maintenance and operation of communications and information technology systems for Unified Security Operations Center (911) and the Hajj Security Forces headquarters buildings in Makkah Al-Mukarramah for a total value of SAR 56 million. The project aims to provide operation and maintenance services for a period of three calendar years, for the following systems:

- TV Network system

- Surveillance camera system

- PABX system

- Video wall system

- Information network system

- Office devices

- Wireless Network system

-

The company announced the contract signoff for an operation and maintenance project for the notification reception and relay system (CAD) at the Unified Security Operations Center (911) in Makkah Al-Mukarramah region, with a total value of SAR 45 million. The project aims to provide operation and maintenance services for the following devices and systems:

- Computer hardware, accessories and peripherals.

- Servers.

- Backup systems

- Local and wide area network devices and components.

- The center’s infrastructure devices and systems.

- Operating systems.

- Geographic applications

- Applications for receiving and analyzing security reports.

- Security monitoring, recording and storage systems.

- Databases

- Telephone devices and systems (IP & IP PBX), voice transmission port network, and voice data recording systems.

| Summary Financial Statements | ||||||||||

| Balance Sheet (SAR million) |

As of 31-Dec-2022 | As of 31-Dec-2023 | ||||||||

| Current Assets | 673 | 1,003 | ||||||||

| Non-current Assets | 134 | 175 | ||||||||

| Total Assets | 807 | 1,178 | ||||||||

| Current Liabilities | 522 | 760 | ||||||||

| Non-Current Liabilities | 32 | 37 | ||||||||

| Total Equity | 254 | 382 | ||||||||

| Total Liabilities and Equity | 807 | 1,178 | ||||||||

|

|

|

|||||||||

| Income Statement (SAR million) For the year ended |

31-Dec-2022 |

31-Dec-2023 |

||||||||

| Revenue | 927 | 1,130 | ||||||||

| Gross profit | 199 | 210 | ||||||||

| Operating Profit | 161 | 174 | ||||||||

| Net Profit | 131 | 129 | ||||||||

|

|

||||||||||

| Cash Flow Statement (SAR million) For the year ended |

31-Dec-2022 |

31-Dec-2023 | ||||||||

| Net cash from (used in) operating activities | (22) | (113) | ||||||||

| Net cash from (used in) financing activities | 40 | 143 | ||||||||

| Net cash from (used in) in investing activities | (20) | (45) | ||||||||

| Change in cash and cash equivalents | (2) | (15) | ||||||||