Publisher: Maaal International Media Company

License: 465734

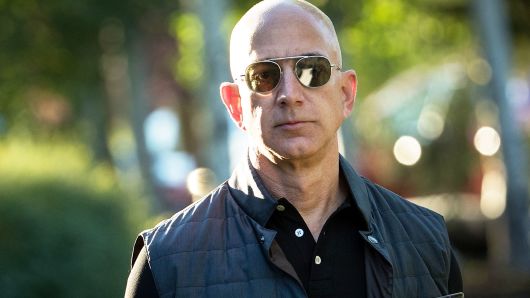

Jeff Bezos avoids paying $600 million in taxes after moving to Miami

Billionaire Jeff Bezos avoided paying $600 million in taxes after selling $2 billion in Amazon shares last week as a result of his move to Miami.

According to CNBC, Bezos announced last season that he was leaving Seattle after nearly 30 years of living there to move to Miami. Adding that he took this step to be closer to his parents and the business of his company, Blue Origin. But the timing of this move revealed another reason: tax avoidance.

Washington state imposed a new capital gains tax of 7% on sales of stocks or bonds worth more than $250,000, while Washington state does not impose a tax on personal income, so the new tax represents the first time that Bezos faces state taxes on sales. His shares.

اقرأ المزيد

In 2022, when the tax took effect, Bezos stopped selling shares that he had started in 1998, and did not sell any shares in Amazon during 2022 or 2023, but he gave only $ 200 million in shares as a gift at the end of last year.

After moving to Miami, Bezos made up for what he missed during the two years. Last week, a document submitted to the US Securities and Exchange Commission revealed that Bezos launched a scheduled plan to sell shares, based on disposing of 50 million shares before January 31, 2025. At today’s price, this would total more than $8.7 billion.

The state of Florida does not tax income or capital gains. So, in last week’s $2 billion sale, Bezos saved $140 million in taxes that he would have paid to the state of Washington. By selling the entire 50 million shares over the next year, he will save at least $610 million, and this is assuming the current share price. In other words, he will avoid paying an amount that could buy him a legendary yacht like the one he bought a while ago.