Publisher: Maaal International Media Company

License: 465734

Saudi banks see moderate improvement in margins and return on equity in third quarter: Alvarez & Marsal

Leading global professional services firm Alvarez & Marsal (A&M) has released its latest Saudi Arabia (KSA) Banking Pulse for Q3 2023. The report highlights growth in net profits recorded among the Kingdom’s lenders with higher operating income and lower impairment charges. Operating income increased by 2.9 percent QoQ, majorly due to net-interest income (NII) growth (+3.8 percent QoQ) but was undermined by a marginal decline in non-core income (-0.5 percent QoQ). Recoveries in impairment charges (-17.9 percent QoQ) supported growth in net profits (+3.8 percent QoQ) to SAR 18.0bn.

The loan-to-deposit (LDR) ratio improved by 2.3 percent QoQ on the back of higher loans-and-advances (L&A) growth to reach 98.4 percent, representing the highest level seen in the last 4 years.

Return on equity (RoE) improved by 70bps QoQ to 16.4 percent, while return on assets (RoA) remained stable at 2 percent. KSA banks witnessed moderate growth in both lending and deposit mobilization. Loans & advances (L&A) increased at a faster pace (+2.9 percent QoQ) than deposits growth (+0.5 percent). Operating income increased marginally by 2.9 percent QoQ, mainly due to NII growth and marginal decline in non-core income (+0.5 percent QoQ).

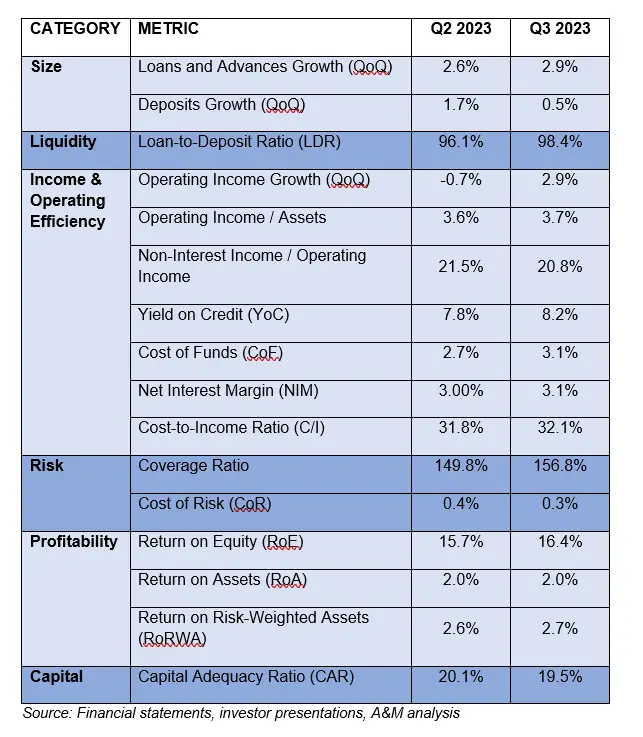

Using independently sourced published market data and 16 different metrics, A&M’s KSA Banking Pulse assesses banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability, and capital, tracking Q3’23 results against Q2’23. The report also offers an overview of the key developments affecting the banking sector in the Kingdom.

The country’s 10 largest listed banks analyzed in A&M’s KSA Banking Pulse are: Saudi National Bank (SNB), Al Rajhi Bank, Riyad Bank (RIBL), Saudi British Bank (SABB), Banque Saudi Fransi (BSF), Arab National Bank (ANB), Alinma Bank, Bank Albilad (BALB), Saudi Investment Bank (SIB) and Bank Aljazira (BJAZ).

The prevailing trends identified for Q3 2023 are as follows:

- L&A increased by 2.9 percent QoQ mainly driven by growth in corporate / wholesale lending (+4.6 percent QoQ). Deposits increased by 0.5 percent QoQ driven by growth in time deposits (+2.2 percent QoQ). Consequently, aggregate loan-to-deposit ratios (LDR) for the top 10 banks increased 2.3 percentage points QoQ to 98.4 percent.

- Total operating income decreased marginally by 2.9 percent QoQ in Q3’23. This was majorly due to an increase in aggregate NII (+3.8 percent QoQ) to SAR 26.3bn, whereas non-core income decreased by 0.5 percent QoQ, lowering total operating income. As the Saudi Arabian Interbank Offered Rate (SAIBOR) increased by 13bps in Q3’23, aggregate total interest cost increased by 14.4 percent QoQ.

- Aggregate net interest margin (NIM) expanded by 6bps to 3.06 percent in Q3’23. Yield on credit (+42bps QoQ) increased to 8.2 percent due to the rise in benchmark rates while the cost of funds (CoF) increased by 32bps QoQ to 3.1 percent. Eight out of the top 10 banks in KSA reported an expansion in NIM.

- Cost-to-income (C/I) ratio deteriorated by 33bps QoQ to reach 32.1 percent. The deterioration was a result of higher operating expense (+3.9 percent QoQ) which increased faster than operating income (+2.9 percent QoQ).

-

The cost of risk (CoR) improved by 8bps QoQ to settle at 0.3 percent in Q3’23 reflecting improved asset quality. Eight out of the top 10 banks reported an improvement in CoR.

- Aggregate net profit of the top 10 KSA banks grew marginally (+3.8 percent QoQ) in Q3’23 mainly on the back of lower impairment charges (-17.9 percent QoQ). The growth in net income resulted in RoE increasing to the highest level of 16.4 percent (+70bps QoQ), since the pandemic with RoA remaining stable at 2.0 percent for the quarter.

OVERVIEW

The table below sets out the key metrics:

Mr. Asad Ahmed, A&M Managing Director and Head of Middle East Financial Services, commented: “Higher LDR and improved spreads led to a profitable third quarter for the KSA banks. Despite a slower uptick in deposits, operating income saw a positive trajectory, primarily fuelled by the growth in NII. While there have been challenges reflected in the deteriorating cost-to-income ratio, the broader improvement in profitability ratios signals continued positive performance.

اقرأ المزيد

“We anticipate a moderate credit growth in Q4’2023, as KSA banks are increasingly turning to medium term borrowing to address the liquidity constraints resulting from high LDR and this is likely to affect NIM. However, the diversification of the non-oil sector such as trade, hospitality, and tourism, coupled with ongoing government spending, positions the Kingdom well for a positive economic counterbalance. While SAMA continues to follow the US Fed on the policy of hiking rates, there are no visible signs on asset quality, and KSA banks remain well capitalized.”