Publisher: Maaal International Media Company

License: 465734

US dollar heads for fifth week of gains

اقرأ المزيد

Dollar is heading for gains for the fifth week against other major currencies, to record the longest series of gains in 15 months, supported by expectations that US interest rates will remain high for a longer period and by turning to safer assets as a result of concerns about the Chinese economy.

However, the dollar pared those gains slightly on Friday as its rise against the yen kept traders wary of the risks of intervention by the Japanese authorities.

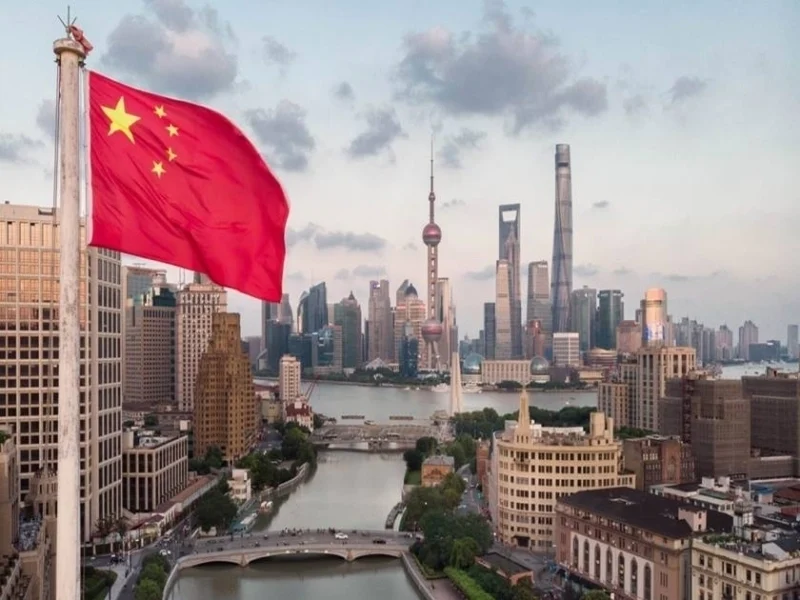

According to “Reuters”, it also appears that the acceleration of the yuan’s depreciation has become a source of concern for the Chinese authorities, as the People’s Bank of China (the central bank) approved a much stronger-than-expected daily reform, which gave the currency some early support after it reached its lowest level the day before. levels in nine months

The dollar index, which measures the performance of the US currency against six other major currencies, including the yen and the euro, fell by 0.02 percent to 103.38 points in Asian trading, after touching last night the highest level in two months at 103.59 points.

It is heading for a 0.5 percent increase during the week

The minutes of the last meeting of the Federal Reserve (the US central bank) on Thursday showed that most members of the interest rate-setting committee still see “significant upside risks to inflation,” which indicates their tendency to raise interest rates again.

Strong economic data released this week, particularly retail sales, has already reinforced the situation for further monetary tightening.

All of this pushed the 10-year Treasury yield to its highest level since October at 4.328 percent on Thursday.

The dollar fell 0.32 percent to 145.365 against the yen on Friday, after reaching a nine-month peak last night at 146.40 points.

Euro rose 0.06 percent to $1.0878, up from a six-week low it hit on Thursday at $1.08565.

The dollar settled approximately at 7.3045 against the yuan in transactions outside China, to compensate for a previous loss of 0.24 percent.

Chinese currency fell to its lowest level in nine months at 7.3490 yesterday, Thursday, in the exchange markets outside the country.

The measures Beijing has taken so far to stimulate the economy are disappointing, although each new data release paints a darker picture of the economic outlook, and the People’s Bank of China cut interest rates earlier this week in a surprise move to widen the yield gap against the United States. , which made the yuan more vulnerable to depreciation

Australian dollar fell 0.05% to $0.6399. It fell to a nine-month low of $0.6365 on Thursday.