Publisher: Maaal International Media Company

License: 465734

Saudi Arabia Maintains Lead in Region’s Automotive Market

A rebound in new vehicle sales, coupled with growing domestic manufacturing capabilities, has solidified the Kingdom’s standing as the largest automotive market in the GCC region with a nearly 50 percent share, according to a report by the U.S.-Saudi Business Council.

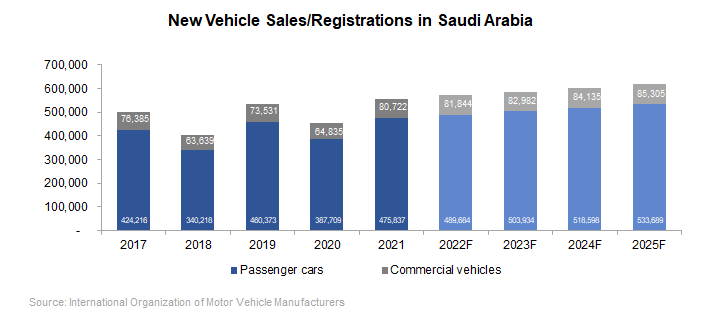

The Kingdom saw 557K new vehicle sales or registrations in 2021, according to the International Organization of Motor Vehicle Manufacturers (OICA). Approximately 86 percent of vehicles imported were passenger vehicles while the remaining 14 percent were commercial vehicles. Sales and registrations of new vehicles rose 23 percent YoY in Saudi Arabia and outpaced regional neighbors U.A.E. and Kuwait. The Kingdom also saw domestic vehicle sales reach 3 percent above pre-COVID levels while the regional average remained 3 percent below pre-COVID levels.

“Demand for new vehicles is expected to remain strong through 2025 as sales are forecasted to reach approximately 619K units. Growth in passenger vehicles will be stimulated by a growing share of female drivers, rising income levels, post-COVID return to offices, and the expansion of tourism destinations to local and international visitors. Commercial vehicles will increase on the back of growing demand for rental vehicles and a pickup in construction activity spurred by Vision 2030 diversification projects” said Albara’a Alwazir, Director of Economic Research at the U.S.-Saudi Business Council.

اقرأ المزيد

While the Kingdom is the 23rd largest auto market in the world, it is the only country in the top 25 without a significant domestic production segment. Therefore, nearly all vehicles operated in Saudi Arabia are imported.

Saudi Arabia has made strides in its efforts to become a manufacturing hub in the region. Its strategic objectives to develop its domestic automotive manufacturing capabilities are guided by the National Development & Logistics Program (NIDLP) and the Industrial Clusters Program, which view both local firms and international companies as critical stakeholders of sectoral development. NIDLP includes an automotive sector strategy that continues importing functional goods like power train, chassis components, and electrical components while domestically producing goods such as small and medium size panels, injection parts, aluminum products, piping, and tubing for full assembly.

Vehicle assembly is another localization strategy that has been primarily concentrated in the heavy commercial vehicle segment. There are four international commercial truck manufacturers currently producing vehicles in-Kingdom: Volvo Trucks, MAN, Mercedes Benz, and Isuzu Motors. Saudi National Automotive Manufacturing Company (SNAM) also signed a partnership with South Korean OEM SsangYong Motor for domestic assembly of the firm’s Rexton sports and Rexton Sports Kahn sport utility vehicles in 2019. SNAM expects to produce 5-10K cars by the second half of 2023 and 30K vehicles by 2030.

PIF serves as the primary vehicle for non-oil economic diversification in Saudi Arabia. In line with these goals, PIF became a majority shareholder in U.S. electric vehicle automaker Lucid Motors with a SAR4.9 billion ($1.3 billion) investment in 2019. This year, Lucid announced it would set up its first overseas factory in Saudi Arabia. The successful launch of the manufacturing facility would mark a major milestone for the Kingdom’s automotive sector. According to Lucid, the facility will be able to produce 150,000 vehicles per year. PIF also announced in late 2021 it was exploring plans to create a new EV car brand called Velocity in partnership with Foxconn and BMW. The planned JV would build EVs on chassis licensed from BMW.

Saudi Arabia is set to remain the leading Middle East vehicle import market and will continue to see high demand for SUVs and luxury vehicles. Growing construction activity will drive continued demand for commercial heavy vehicles. Improved road infrastructure will be supported by government revenues bolstered by high oil prices. Major tourism spending by the government will also have a positive impact on expanding transportation infrastructure throughout the country. The development of the recreational tourism sector will stimulate the rental car market in the Kingdom, which stands to benefit from increased flows of both domestic and inbound tourists.

The success of the Lucid Motors manufacturing facility will serve as an indicator for other foreign OEMs to consider similar investments. Lucid will benefit from existing industrial clusters with leading Saudi business partners such as SABIC, Ma’aden, and Saudi Aramco to produce advanced automotive materials that include carbon black and synthetic rubber for tires, carbon fiber, nylon 66 and other automobile related components. Local components manufacturing across plastics, rubbers, petrochemicals, and metals supply chains will continue to grow as the Kingdom’s non-oil manufacturing expands. There remains a number of potential goods such as body panels, trunk liners, and taillights that are poised to benefit from new investments. Automotive manufacturing clusters will remain one of the leading opportunities for foreign investors to facilitate the expansion of related supply chains.