Publisher: Maaal International Media Company

License: 465734

By Zakat, tax, and customs

Egregious Infractions of online Billing Application, related Penalties Announced

اقرأ المزيد

The most serious violations of the first phase of online invoicing or billing (electronic issuing and preservation) and egregious penalties, shall take effect, on December 4, 2021, Zakat, Tax and Customs Authority, announced.

Clarifying that the penalty for not issuing and keeping invoices electronically, starts with a fine of SR5,000, the authority pointed out that not including the QR Code in the simplified tax invoice, a violation for not writing the facility’s value-added tax registration number on tax invoices, and a violation for not informing the authorities, shall be among punishable violations.

Punishment starts with a notice to the facility for any malfunction that prevents the issuance of electronic bills.

The authorities further stated that removing or changing electronic bills, after they have been issued, is punishable, too, by a SR10,000 fine, adding that all penalties are calculated based on the type of infringement and the number of times of repeated occurrence.

More details about the violations and fines related to the electronic billing application can be got, by visiting the authority’s website via the link https://bit.ly/30sdrlN.

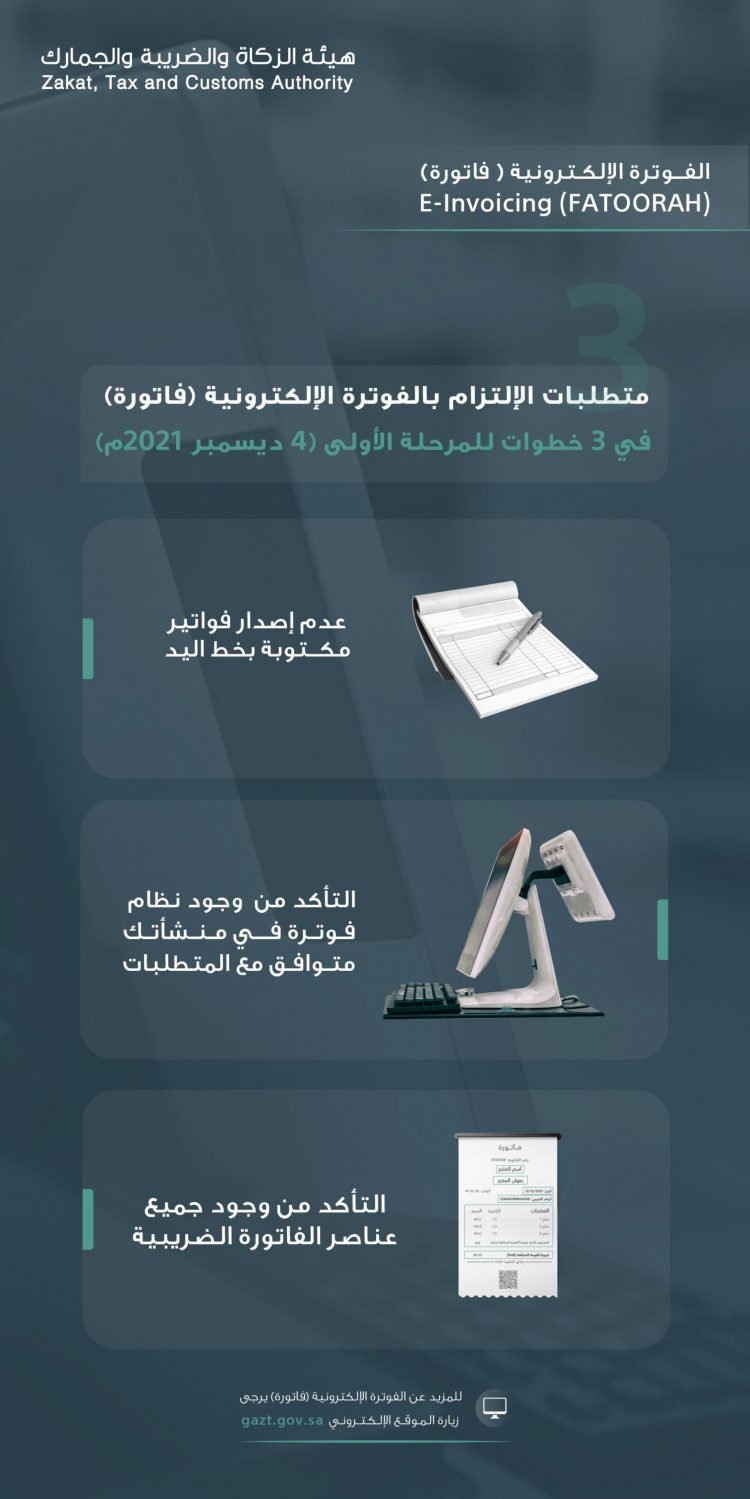

The authority emphasized the relevance and necessity of all taxpayers, who are subject to the electronic billing rule, being prepared to meet the requirements of the first phase of electronic billing, known as “Fatoorah”

The requirements for compliance with the first stage are to completely stop using handwritten invoices or invoices written on computers, using text editing programs, or number analysis programs, as well as to ensure that there is a technical solution compatible with the requirements of electronic billing, as well as to ensure that electronic invoices are issued and preserved, in all items, including the QR code for simplified tax invoices, the tax number of the business, and to ensure that electronic invoices are issued and preserved, in all items, including the QR code for simplified tax invoices.

At the link (https://bit.ly/3zsReQM), the authority stated that taxpayers subject to electronic invoicing can view a non-binding indicative list of providers of technical solutions for electronic invoicing, in order to select the appropriate technical solution for the volume of the facility and the type of sector, stressing that the list should not be interpreted as limited to providing electronic billing solutions to telecommunications companies.

The Zakat, Tax and Customs Authority urged taxpayers who are subject to electronic billing, as well as providers of electronic billing systems and those who are interested, to contact it with any questions about electronic billing via the call center’s unified number (19993), operating 24 hours a day, seven days a week, or through the “Ask Zakat” account.

Tax and Customs” via Twitter (@zatca Care), e-mail (info@zatca.gov.sa), or live chat on the website (zatca.gov.sa).