Publisher: Maaal International Media Company

License: 465734

Arabian Mills announces its intention to float on the Main Market of the Saudi Exchange

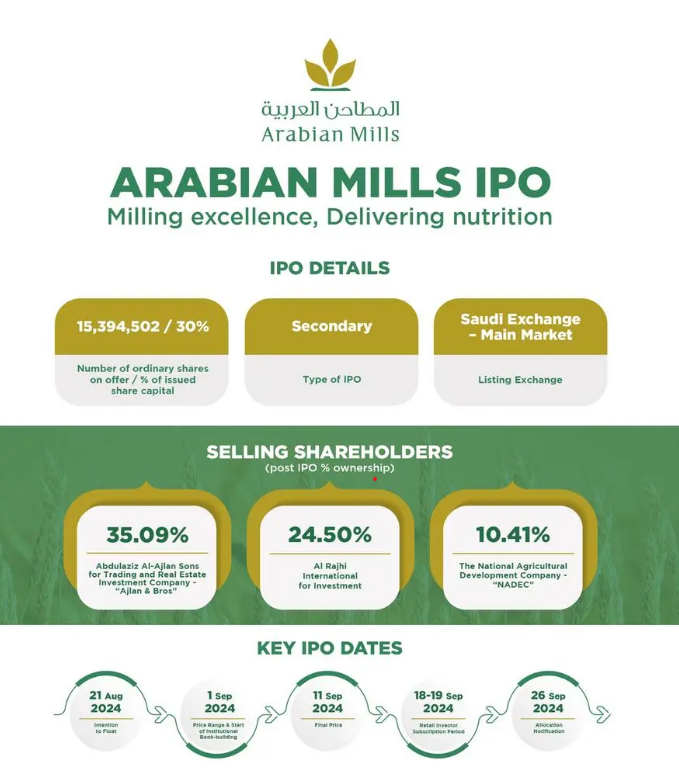

Arabian Mills for Food Products Company (“Arabian Mills” or the “Company”), one of the market-leading flour milling companies in the Kingdom of Saudi Arabia (“KSA” or the “Kingdom”), announces its intention to proceed with an initial public offering (“IPO” or “Offering”) and the listing of its ordinary shares (“Shares”) on the Main Market of the Saudi Exchange (“Tadawul”).

On 24 June 2024G, the Capital Market Authority (the “CMA”) approved the Company’s application for registering its shares and the Offering of fifteen million three hundred and ninety-four thousand five hundred and two (15,394,502) Shares (“Offer Shares”), representing 30% of the Company’s issued share capital, by way of a sale of existing shares by Abdulaziz Al-Ajlan Sons for Trading and Real Estate Investment Company – Ajlan & Bros (“Ajlan & Bros”), Sulaiman Abdulaziz Al-Rajhi International Company, and The National Agricultural Development Company (“NADEC”) (collectively, the “Selling Shareholders”). The final offer price of the Offer shares will be determined at the end of the book-building period.

Company Overview

اقرأ المزيد

- Arabian Mills operates in KSA’s consumer staples market. It produces, distributes and sells wheat flour and derivative products, animal feed and bran to customers across the Kingdom.

- It is one of the marketleading milling companies in the Gulf Cooperation Council (the “GCC”), with the largest daily flour production capacity in KSA.

- The Company is strategically located in Riyadh and has two other plants located in Hail and Jazan, close to livestock farming and tourism hubs serving other key regions.

- Arabian Mills has built trusted partnerships with its broad and growing network of customers including bakeries, farmers, wholesalers, food service companies, retailers (supermarkets, convenience stores) and end consumers.

- The Company has some of the most highquality wheat flour, feed and bran products in the market; with a diversified portfolio of future products driven by its cutting-edge R&D lab.

- Arabian Mills has fully automated, worldclass facilities, led and empowered by a team of highly skilled millers and management.

- Since its privatization in 2021, the Company has consistently delivered strong financial performance with industryleading profitability margins and robust cash flow generation.

- Arabian Mills is deeply committed to prioritizing sustainability, ethics, and customer satisfaction to enhance the quality of life and standard of health and contribute to KSA’s food security agenda.

- The Company is executing its strategy to accelerate growth and drive outperformance.

Ajlan Alajlan, Chairman, Arabian Mills, said:

“Today we are one of the leading wheat and feed milling companies in Saudi Arabia. Our commitment to quality and excellence is resolute, enabling us to serve the Saudi community’s daily nutrition needs while contributing to the Kingdom’s food security agenda.

The decision to go public is a natural next step for Arabian Mills. It will provide us with the platform to invest and expand our production capacities and capabilities, and expand our product portfolio to meet the growing demand from KSA’s growing F&B and agribusiness while furthering our ambitions to embed sustainable practices at every step of the milling and distribution process.

With the support of new shareholders, we aim to take Arabian Mills to new heights, driving growth and creating long-term value for all stakeholders in line with Saudi Vision 2030. We look forward to this exciting new chapter and the opportunities it brings.”

Rohit Chugh, Chief Executive Officer, Arabian Mills, added:

“The decision to go public is a decisive one toward accelerating our growth trajectory. Since our privatization in 2021, we have significantly scaled the business, increased profitability margins, and strengthened our market share. This was only made possible thanks to the efforts of our teams and the backing of our shareholders.

Looking ahead, the growing market for flour, feed, and bran in the Kingdom presents compelling opportunities, and we are well-positioned to capitalize on robust demand through continuous innovation and quality enhancements. Our focused strategy will deliver value and further our growth ambitions. We have a robust product pipeline, which includes the launch of new SKUs and variations tailored to meet diverse consumer needs and preferences, supported by an effective marketing and sales strategy. We are also expanding our presence in the Kingdom by opening distribution centers in strategic locations to ensure we reach more customers more efficiently. To support our expansion plans, we are constantly enhancing our operations to optimize utilization, minimize downtime and enhance our margins.

By going public, we are also committing to higher standards of transparency and corporate governance, which we believe will ultimately benefit our shareholders and other stakeholders alike. This IPO is a catalyst for Arabian Mills to achieve sustainable, long-term growth and to continue our purpose of driving milling excellence and delivering nutrition.”