Publisher: Maaal International Media Company

License: 465734

IMF expects strong Saudi non-oil economy growth at around 5%

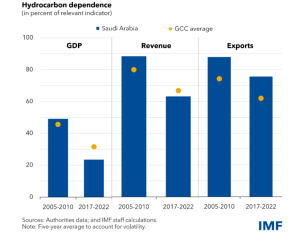

A report issued by the International Monetary Fund today confirmed that the Kingdom’s economy is witnessing transformations against the backdrop of implementing reforms to reduce dependence on oil, diversify sources of income, and enhance competitiveness.

The report explained that this year represents an important turning point as it is the midpoint in the Kingdom’s ambitious Vision 2030 journey, noting that the International Monetary Fund’s latest annual review of the Kingdom’s economy reflects significant progress in the growth of the non-oil economy, which has accelerated since 2021, reaching… The average will reach 4.8% in 2022, despite the decline in overall growth due to additional voluntary cuts in oil production, expecting non-oil sector growth to remain close to 5% in 2023, driven by strong domestic demand.

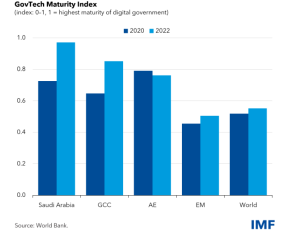

The report confirmed that diversification in the Saudi economy was driven by improvements in the regulatory and commercial environment and as a result of the implementation of a new set of laws aimed at promoting entrepreneurship, protecting investors’ rights, and reducing the costs of doing business, as new investment deals and licenses grew by 95% and 267%. Successively in 2022. In addition, the Public Investment Fund (PIF) pumped more investments that helped stimulate private sector investments.

اقرأ المزيد

The report indicated that the growth of the non-oil sector in the Saudi economy is currently driven by strong domestic demand, especially non-oil private investment. Maintaining this performance requires continuing to pursue sound macroeconomic policies and maintaining reform momentum, regardless of developments in oil markets.

Regarding the challenges, the report explained that at the forefront will be ensuring that large projects generate revenues and enhance productivity, which is vital for sustainable economic growth and will help further diversify the economy. There is also a need to continue ongoing efforts to foster a more conducive environment for innovation and investment in workforce skills that complement the diversification agenda.

He pointed out that simplifying the fees and taxes faced by companies – especially at the local and city levels – would enhance the growth of the private sector.

The report recommended the continued growing role of the Public Investment Fund in the economy to stimulate private sector investment pointing out that careful investments will help reduce the risks resulting from targeted interventions and industrial policies, and ensure the ability of these policies to achieve the desired benefits.