Publisher: Maaal International Media Company

License: 465734

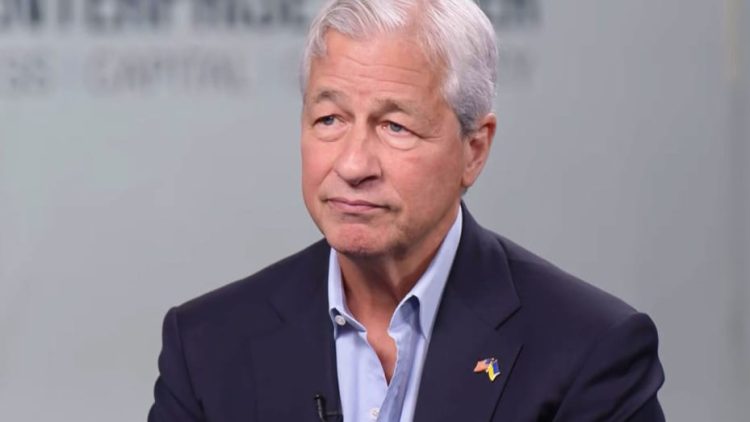

“JP Morgan” CEO warns of a crisis facing banks due to commercial real estate

اقرأ المزيد

Deposit withdrawals led to the collapse of three US banks this year, but other concerns loom on the horizon.

Jamie Dimon, CEO of JPMorgan Chase Bank, warned of a possible crisis due to commercial real estate.

“There’s always skew,” Dimon said during the bank’s investor conference. “It is possible that the parties outside in this case are real estate.

Dimon said, according to “CNBC” that banks – especially the smaller ones will be hardest hit by the recent turmoil in the banking industry, pointing out that they need to plan for interest rates to rise much higher than most of them expect. “I think everyone should be prepared for interest rates about 6% or 7% higher,” Dimon said.

The Fed concluded last month that mismanagement of interest rate risk contributed to the failure of the Silicon Valley bank earlier this year.

While US banks have seen a historic decline in loan defaults over the past few years due to low interest rates and an influx of stimulus money released during the COVID-19 pandemic. But the Federal Reserve raised interest rates to fight inflation, which changed the landscape. Commercial buildings could be damaged in some markets, including the technology-focused city of San Francisco, where remote workers are reluctant to return to offices.