Publisher: Maaal International Media Company

License: 465734

Inflation in the Kingdom between the Impact of VAT and Liquidity Growth

Dr. Said Alshaikh

Business and Technology University

اقرأ المزيد

Strong growth in global pent-up demand and a shortage of goods and services, which followed easing of travel restrictions and elimination of the precautionary measures imposed due to the CORONA pandemic in most countries of the world, led to a significant rise in consumer prices. Accordingly, global inflation rose by 8.5% year-on-year in November 2021 according to the OECD Consumer Price Index.

Except for Japan, most developed economies experienced high levels of inflation.

This situation has raised concerns about whether the world is on the cusp of a new and potentially long-term inflationary cycle, which has already led to a shift in monetary policy orientation by many central banks.

The US Federal Reserve and the European Central Bank already stated the prospects of moving from a quantitative easing to a gradual monetary policy tightening.

These concerns about global inflation more likely would continue as the supply chain bottlenecks remain widespread, and the recovery of the global economy stay strong in the major economies.

Regarding inflation in Saudi Arabia, in addition to being influenced by global price rises and as result reflected in higher import prices, the significant increase in inflation figures was more closely linked to the domestic fiscal and monetary policy developments.

Following the collapse in oil prices starting in the fourth quarter of 2014 and remaining at low levels in the years 2015 and 2016, this situation has caused a sharp decline in the government’s oil revenues, as it has become urgent for fiscal policymakers in the Kingdom to seek alternative sources of revenue to offset this sharp decline.

The government then made its decision to reform the public finances, issuing the Fiscal Balance Program (FBP 2020), which was part of the Vision 2030, and then later was amended to FBP 2023. As part of FBP’s revenue diversification measures, a 5%VAT was introduced beginning January 2018, as well as a gradual increase in expatriate levies to be paid by employing companies along with fees to be paid by foreign employees on their dependents.

These financial measures also coincided with the government’s decisions to reduce fuel subsidies, causing the prices of gasoline, electricity and water to rise, which in turn led to higher cost of production.

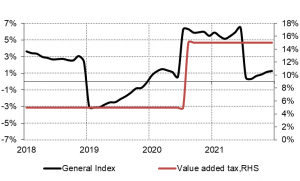

Taken all together, these measures, particularly VAT, contributed to a 3.3% rise in the January 2108 general consumer price index (Chart 1).

Chart (1): Inflation and Value Added Tax

Given the wide range of taxation to generate revenues and the fact that it was a consumption tax that included a range of indispensable basic goods and services such as food and fuel, consumers had no options to replace them in other categories of goods and services, keeping demand high as prices continued to rise.

Consequently, price inflation has weakened the purchasing power of the local currency.

The general price index fluctuated slightly during 2018 but remained elevated at around 3% throughout the year.

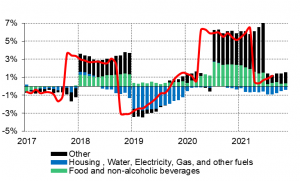

As the change in the general price index came from January 2018 in conjunction with the introduction of VAT, it confirms that the price increase was not linked to consumer behavior as a result of an increase in demand for goods and services, but on the contrary, consumer purchasing power has declined, which may have had a negative impact on demand. However, from July 2018, the category of housing, water and electricity price index fell as this category price contraction continued at a declining pace in 2019.

This reflected itself in the trend of the general price index, which contracted to reach -3.6% in January 2019, and then contraction gradually lessened during the year to -0.18% by the end of the year (Chart 2).

Chart (2): General Price Index by Category

At the beginning of 2020, the general consumer price index returned to a gradual year-on-year rise through June before rising to 6.18% year-on-year in July 2020.

This sharp rise came on the back of the government’s decision to raise VAT from 5% to 15% beginning of July 2020.

This decision followed the collapse of oil prices to unprecedented levels, averaging $18 per barrel in April 2020, which was attributed to restrictive measures on travel and business activity introduced by most countries around the world in order to reduce the spread of Coronavirus.

The general price index stayed at high levels between 5% and 6% monthly year-on-year until June 2021.

However, price increases between categories of goods and services varied greatly, as for example, the price index in the insurance category rose by 19.2% year-on-year in December 2020, and the price index in the food and beverage category rose by 12.7% year-on-year during the same period.

As the measure of inflation normally is estimated monthly year-on-year, then from the beginning of July 2021, it rose on top of the 6.18% rate already reached in July of the previous year by 0.43%.

It continued to increase year-year every month to reach 1.24% in December 2021 also on top of the 5.33% rate already reached in December 2020, totaling 6.57%. By the same measure, the cumulative inflation rate for 2020 and 2021 in the food and beverage category amounted to 13.8%.

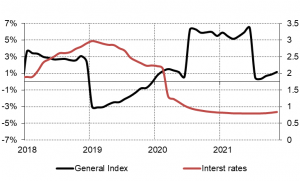

Taking into account that inflation is a monetary phenomenon, it is therefore influenced by interest rate rates and liquidity levels in the economy. With respect to interest rate on the Saudi Riyal for three months, it has peaked at 2.97% in January 2019 but then declined during the year to reach 2.23% in December 2019. However, in the face of the economic slowdown in the US as a result of the restrictions on travel, mobility and economic activity due to the coronavirus pandemic, in March 2020, the US Federal Reserve has taken the decision to lower interest rate on the Federal Reserve loans and to expand purchases of government bonds and mortgage-backed securities, which contributed to the injection of liquidity with US banks.

This in turn led to the expansion of lending to households and companies, which in turn contributed significantly to lower the interest rate on US Dollar, reaching 0.12% (12 basis points) in October 2021.

Given that the exchange rate of the Saudi riyal is pigged to the US dollar, Also in March 2020, the Central Bank of Saudi Arabia (SAMA) reduced the repurchase agreement rate (repo rate) to 1% and the rate of the reverse repurchase agreement rate (reverse repo rate) to 0.5%.

Accordingly, the average Saudi interbank interest rate for three months (SIBOR) fell to reach 0.79% in June 2021, then rose slightly to 0.84% in November 2021 (Chart 3).

Chart (3): Inflation and Interest Rates

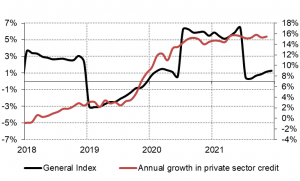

This significant decline in interest rates has increased the demand for loans from companies and households, particularly in the mortgage financing category, with private sector bank credit growing by 14.25% in 2020 and then rising by 15.3% year-on-year in November 2021.

This monetary easing policy has contributed to Increasing of liquidity, as the growth of aggregate money supply, which includes cash in circulation and demand deposits (M1), jumped from 5.5% in 2019 to 15.5% in 2020, and then at a rate of 5.2% year-on-year in November 2021.

This high growth in liquidity rates has, of course, led to an expansion of financing the pent-up consumption and investment and thus increased demand for goods and services.

On the other hand, the easy monetary policy has contributed to mitigating the negative effects of the tight (contractionary) fiscal policy, which was due to increasing of VAT, on the economic growth of the private sector. However, with increased demand for goods and services driven by liquidity growth and lower interest rates, the overall price index continued to rise (Chart 4).

Chart (4): Inflation and Private Sector Bank Credit

لتحميل الملفات المرفق

saeed_alsheikh-1.jpg