Publisher: Maaal International Media Company

License: 465734

Weekly Energy Recap: January 14, 2022

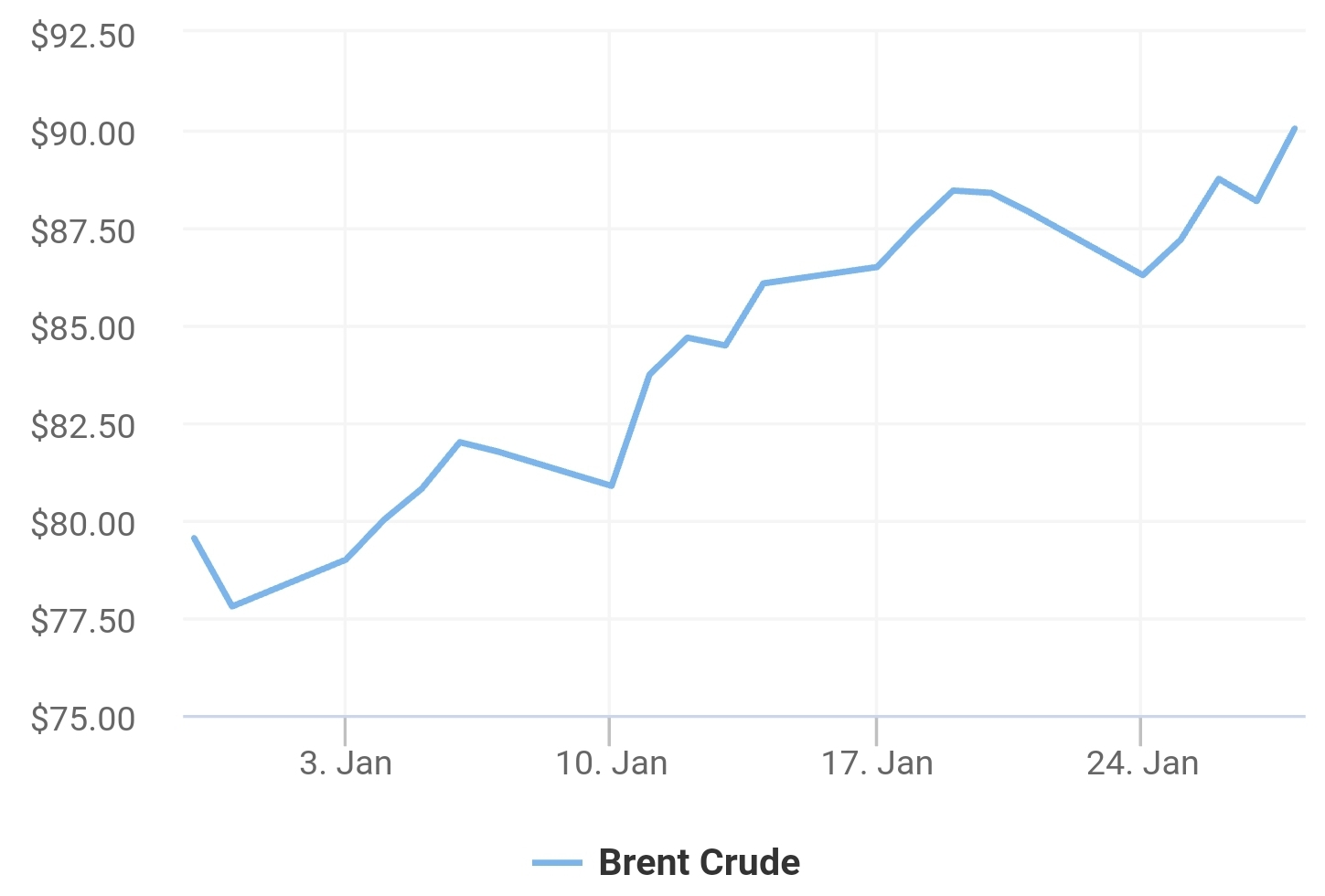

The second week on Year 2022 ended with both benchmarks Brent and WTI have settled comfortably above the $80 mark.

Brent crude closed the week higher at $86.06 per barrel, WTI also closed the week higher at $83.82 per barrel.

Brent/WTI spread has narrowed to $2.24 per barrel.

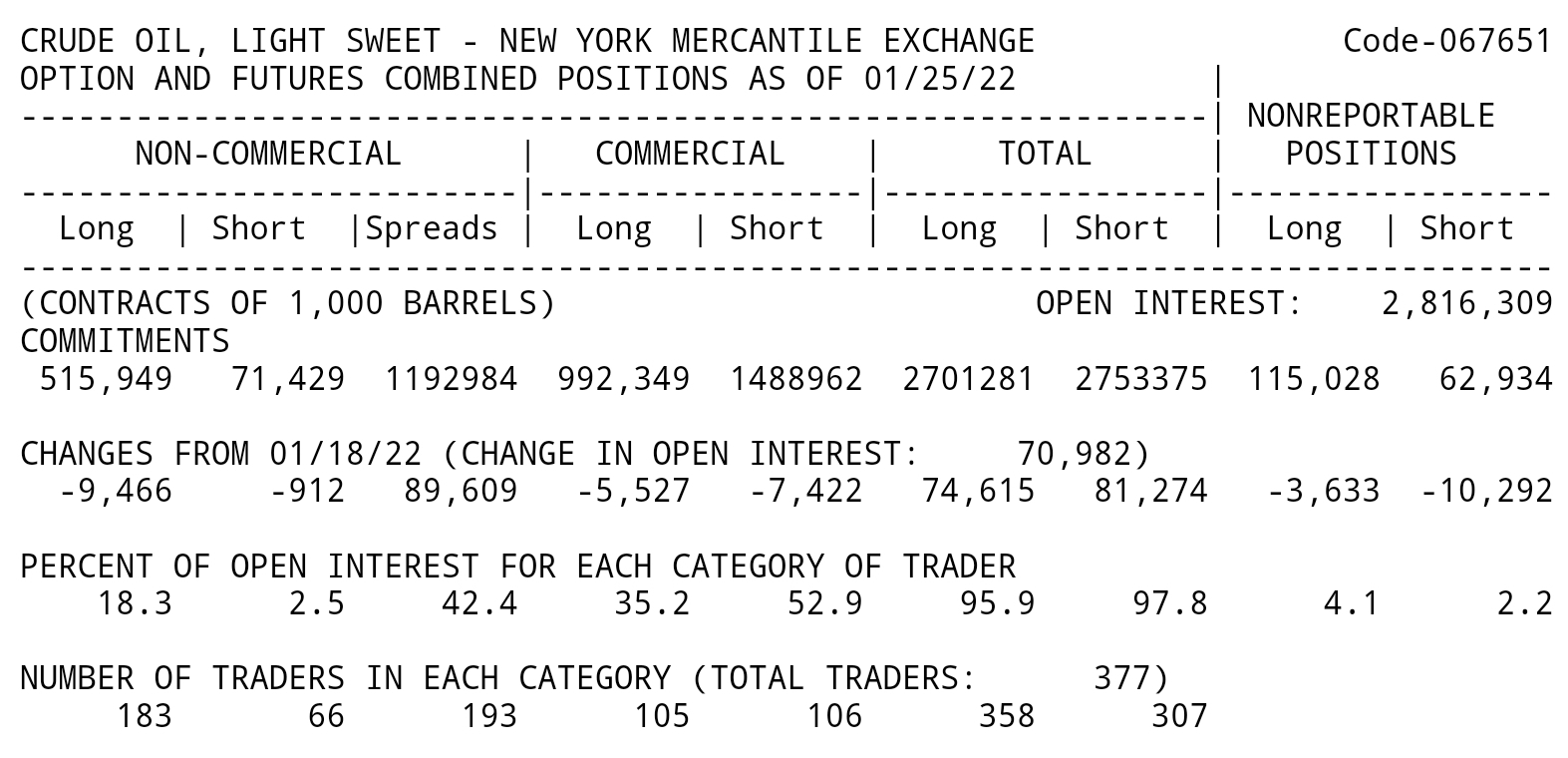

The latest figures from the Commodity Futures Trading Commission (CFTC) on January 11, 2022, showed that long positions on crude oil futures on the New York Mercantile Exchange (NYMEX) numbered 501,453 contracts, up by 21,746 contracts from the previous week (1,000 barrels for each contract).

اقرأ المزيد

WTI futures (long contracts) are back above the 500,000-mark contracts, which means that investors are back betting on higher prices upward momentum with expectations of further increases.

Higher speculators activities came despite the US Energy Information Administration (EIA) bullish outlook for the US oil production new records in 2023 to exceed pre-pandemic levels, driven by a jump in shale oil output.

EIA forecasts US oil production to average 12.4 barrels per day, in 2023.

US oil production reached 11.8 barrels per day at the end of December 2021.

However, the annual average of US oil production fell in 2021 by 100,000 bpd to average 11.2 million bpd due to weather-related shut-ins during the Texas Freeze in February and Hurricane Ida in August and September 2021.

Keeping in mind that EIA expects US consumption to slightly surpass 2019 levels to average 20.6 million bpd, led by higher gasoline consumption.

In my opinion geopolitics don’t seem to have an impact on global oil markets like before the pandemic.

Hence, the large oil prices weekly gain wasn’t amid Kazakhstan protests last week but as a result of continuing strong market fundamentals as the impact of the Omicron variant proved weak with growing oil demand outstripping bearish sentiments.

Energy Adviser (former OPEC and Saudi Aramco)